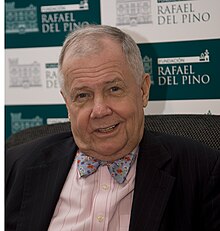

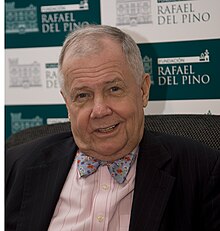

James Beeland Rogers, Jr. (born October 19, 1942)

Return to KirkLindstrom.com home page

|

Jim Rogers Market

Update James Beeland Rogers, Jr. (born October 19, 1942) |

|

| Charts

and current price quote for Crude Oil Prices Return to KirkLindstrom.com home page |

|

|

| James Beeland Rogers1, Jr. (born October 19, 1942) is an American investor and author. He is currently based in Singapore. Rogers is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the Quantum Fund with George Soros and creator of the Rogers International Commodities Index (RICI). Rogers does not consider himself a member of any school of economic thought, but has acknowledged that his views best fit the label of Austrian School of economics |

|

June

11, 2012: Today Jim Rogers,

chairman of "Rogers Holdings," was a guest

on CNBC's "Halftime Report" where he was

interviews by Scott Wapner. Below is a

summary of his comments.

"Central banks are printing a lot of money...." "The solution to too much debt is not more debt.... I'd let them go bankrupt. "When you fail you fail. Competent people come in, take over the assets, reorganize and start over. What we are doing in the West is taking the assets from the competent people, giving them to the incompetent people then saying "now you compete with the competent people with their money! It is absurd economics, it is absurd morality and it is absurd economics (yes twice.)." "I am long a lot of stuff..... somebody has to pay the piper." Gold: Rogers told the Fast-money traders he owns gold and would like to own more but he asked them where is the bottom? .... Rogers said if India does do something, gold could go to $1200 or $1300 per ounce in the short term. Charts and price quotes for: Gold and Gold ETF GLDRogers said he is "short India and most emerging markets" but asked the traders on CNBC what will governments do if things slow down. Rogers said governments will try to stimulate growth by printing money. He said they are not very smart people, that is why they work for the government. He said that when they print, real assets will go through the roof. Charts and price quote for CRBQ a global commodity Equity Index ETFRogers is short technology. He doesn't like Apple in terms of the "Basket Play" but of course wishes he bought it two years ago. Rogers said "technology is too expensive for me." Rogers says his current hedges are short technology in the US and he is short Europe. On China: Rogers said "I don't pay any attention to any government numbers because they are all made up." He explained the US and China, all governments, make up the numbers so he doesn't pay attention to them. He says the best way to play China is commodities. (Of course he owns/runs a commodities fund he'd like you to invest in.) His FAVORITE commodity is agriculture. My take is he believes China is a secular growth story so he ignores the quarterly government growth statistics as noise while paying attention to the long-term trend is they are growing out of poverty with a huge opportunity if you invest in what they need to grow which is resources. "The United States is the largest debtor nation in the history of the world. How can you consider that a safe haven?" He currently owns the dollar because of the flight to perceived quality from other parts of the world. He is not short the Euro since "everyone is short the Euro" but he is not long either.

|

|

|

Article: Beware

of

Annuities

Article

Index

|

|

|

|

| Charts and current price quote for Crude Oil Prices | |||

|

KirkLindstrom.com Home of "CORE & Explore®" investing. |

Blog |

|

Disclaimer: The information contained in this seb site is not intended to constitute financial advice, and is not a recommendation or solicitation to buy, sell or hold any security. This blog is strictly informational and educational and is not to be construed as any kind of financial advice, investment advice or legal advice. Copyright © 2012 Kirk Lindstrom. Note: "CORE & Explore®" was coined by and is a registered trademark of Charles Schwab & Co., Inc. |

|||