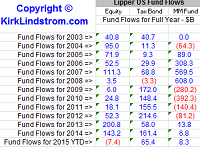

Lipper FMI (formerly AMG) Fund Flow Chart

==> Return to KirkLindstrom.com home page <==

|

Lipper FMI Weekly Fund Flows Lipper FMI (formerly AMG) Fund Flow Chart |

|

| ==> Return to KirkLindstrom.com home page <== |

|

|

|||||||||||

October 10, 2015: Weekly and Year-to-date US equity fund flow values are in the red (negative) now. The Lipper FMI Weekly Fund Flow report adds to understanding of the effects of investor demand on price action in the securities markets. Weekly flows are aggregated to calculate and report a moving average, which describes the weekly ‘Flow Rate’ graphed below.

It should be no surprise fund flows are negative for the year as the markets are down for the year. Every week I record the "Weekly Survey Results" data (shown above) on an Excel spreadsheet then I take the running sum for the year to calculate "Fund Flows for 2015 YTD". I also calculate the total running sum going back to the start of years back to 2003. This table shows the results of my calculations.

|

|||||||||||

|

From Lipperusfundflows.com (pdf):

"The Lipper FMI Fund Flows database consists of the assets of all open-end mutual funds in the United States mutual fund industry distributed on a weekly basis since January, 1992. Asset and price changes in each fund share class are calculated to differentiate the asset change due to net investor flows from the asset change due to market performance. Reports on the fund flow component have been maintained and added to a dataset now consisting of 18,400 share classes managing assets of $9.4 Trillion. The funds can be aggregated by sector, investment style, fund complex, or drilled-down and flows reported for individual or combined fund share classes. Funds report information in weekly and monthly frequencies. Weekly reported information is distributed in 12-week aggregate reports and rankings by sector. These 12-week reports provide the basis for Lipper FMI’s legacy business. Many Lipper FMI customers have upgraded their subscription to all historical information (780 weeks; 15 years) in all sectors. Weekly and monthly reported flows are aggregated to calculate and report a moving average, which describes the weekly ‘Flow Rate ’. This enables a calculation of the rate of flow for an entire fund dataset, reporting both weekly and monthly. "

==> Best CD Rates with FDIC <== |

|

||

| |||

| TOP of Page Kirk's Newsletter: Subscribe - Charts |

||

|

KirkLindstrom.com Home of "CORE & Explore®" investing. |

Blog |

Disclaimer: The information contained

in this web site is not intended to constitute

financial advice, and is not a recommendation or

solicitation to buy, sell or hold any security.

This blog is strictly informational and

educational and is not to be construed as any kind

of financial advice, investment advice or legal

advice. Copyright © 2015 Kirk Lindstrom.

Note: "CORE & Explore®" was coined by and

is a registered trademark of Charles Schwab &

Co., Inc.

|

||