Current iBond Rate = 3.11%

Return to KirkLindstrom.com home page

|

Series I Savings Bonds Current iBond Rate = 3.11% |

|

| I-Bond

Base & Composite Rate History Return to KirkLindstrom.com home page |

November 1, 2024

Announcement: The Bureau of the

Public Debt announced1

earnings rates for Series I Savings Bonds and Series

EE Savings Bonds, issued from November 2024 through

April 2025. November 1, 2024

Announcement: The Bureau of the

Public Debt announced1

earnings rates for Series I Savings Bonds and Series

EE Savings Bonds, issued from November 2024 through

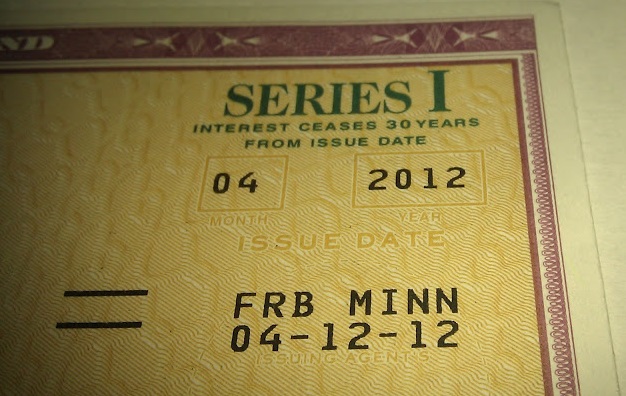

April 2025. I bond fixed rates are determined each May 1 and November 1. Each fixed rate applies to all I-bonds issued in the six months following the rate determination. "The composite rate for Series I Savings Bonds is a combination of a fixed rate, which applies for the 30-year life of the bond, and the semiannual inflation rate. The 3.11% composite rate for I bonds issued from November 2024 through April 2025 applies for the first six months after the issue date. The composite rate combines a 1.20% fixed rate of return with the 1.90% annualized rate of inflation as measured by the Consumer Price Index for all Urban Consumers (CPI-U). The CPI-U increased from 312.332 in March 2024 to 315.301 in September 2024, a six-month change of 0.95%." When the inflation rate is less than zero, the earnings rate will be less than the fixed rate but never less than zero. Calculation Link. ==> Composite Rates for Older Series I Bonds & I-Bond Base & Composite Rate History ==> I cover I-Bonds and a slightly better recommended alternative (just as safe with higher yield but without the tax deferral so better for IRAs) in my newsletter. <== |

|

| ==> NEVER

lose money with I Bonds: The combined rate

will never be less than 0. However, the combined rate

can be lower than the fixed rate. If the inflation rate

is negative (because we have deflation, not inflation),

it can offset some of the fixed rate. If the inflation

rate is so negative that it would take away more than

the fixed rate, the 6-month combined rate stops at

0.00%. More about Series I Bonds: |

|

More about Series I Bonds:

When the inflation rate is less than zero, a bond's earnings rate is less than its fixed rate (but the earnings rate is never less than zero). The fixed rate

applies for the 30-year life of I bonds purchased

during this six-month period.

For older i-bonds and what they

will pay, see: I Bond Composite Rates (iBonds)Earnings rates for I bonds are set each May 1 and November 1. Interest accrues monthly and compounds semiannually. Bonds held less than five years are subject to a three-month interest penalty. I Bonds have an interest-bearing life of 30 years.

Note 1: Press Releases: http://www.treasurydirect.gov/news/news.htm Minimum purchase:

Maximum purchase(per

calendar year):

Denominations:

TreasuryDirect.gov > Products in Depth > I Savings Bonds |

|

||

|

Disclosure: I own

individual TIPS and Series I Bonds in my personal

accounts with base rates between 0.00% and 3.00%. That

means I get as much as 3.00% if inflation falls to zero

percent! I have no plans to sell the i-bonds

with 3.00% base rates until they stop paying interest in

2031. I also own individual TIPS in my

IRAs. I have also recommended individual TIPS and

I-Bonds in my newsletter

which you can read now to see my current

recommendations. |

|||

|

KirkLindstrom.com Home of "CORE & Explore®" investing. |

Blog |

| Disclaimer: The information contained in this web site is not intended to constitute financial advice, and is not a recommendation or solicitation to buy, sell or hold any security. This blog is strictly informational and educational and is not to be construed as any kind of financial advice, investment advice or legal advice. Copyright © Kirk Lindstrom. Note: "CORE & Explore®" was coined by and is a registered trademark of Charles Schwab & Co., Inc. | ||